Top Reasons For Selecting Forex Software

Wiki Article

What Are Automated Trading System?

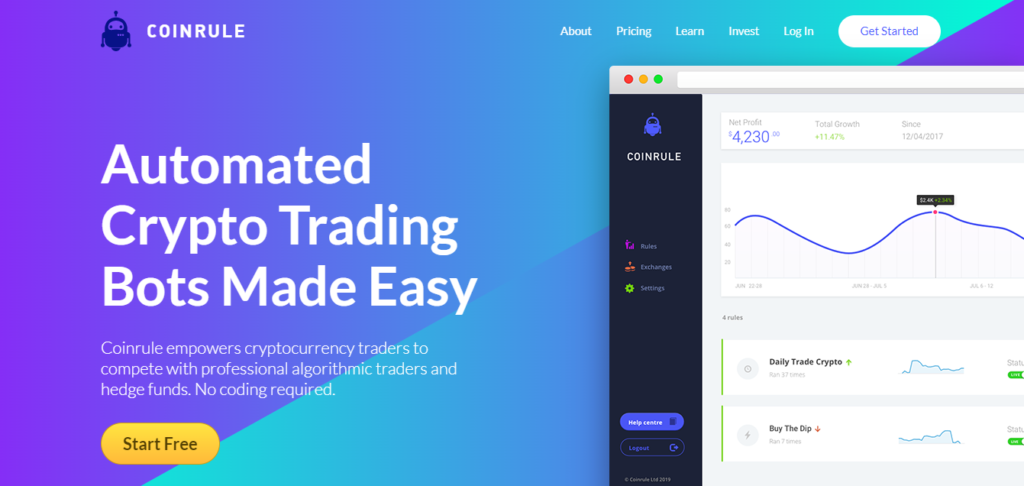

Automated trade systems are also known as algorithmic or black-box that employ mathematical algorithms that make trades for certain circumstances. Automated trading systems can execute trades with no human intervention.

Rules for trading- Automated trading systems are equipped with specific trading rules and conditions that decide the time to start and end trades.

Data input- Automated trading platforms process huge amounts of market data in real time and use these data to take trading choices.

Execution- Automated systems for trading can execute trades in a controlled manner at a speed and frequency which isn't possible with humans.

Risk management- In order to limit losses Automated trading systems can also be programmed to use risk management strategies such stop-loss order or position sizing.

BacktestingAutomated trading systems may be tested back to assess their performance and identify any problems before they are deployed in live trading.

The best thing about automated trading platforms is their capacity to perform trades fast efficiently, precisely, and without the need of human intervention. Automated trading platforms can handle large quantities of data in real time and create trades based upon specific rules and conditions. This can reduce emotional trading and increase the consistency.

But, there are certain risks that come using automated trading systems, including the potential for system failure, errors in the trading rules, as well as an absence of transparency in the trading process. Before using an automated trading system for live trading, it's essential to thoroughly test it. Read the recommended stop loss for site advice including automated cryptocurrency trading, best free crypto trading bot, backtesting tradingview, best crypto trading bot, automated trading software free, forex trading, crypto trading, trading platform cryptocurrency, backtesting trading strategies, backtesting strategies and more.

What Exactly Is An Automated Trading System Work?

Automated trading systems work by processing huge quantities of market data in real-time and trading based on certain rules and conditions. It is possible to break it down to the following steps. The definition of the trading strategy The first step is to determine the plan of trading that will include the specific rules and conditions that govern when trades are entered or removed. These could be indicators of technical nature like moving averages, or other conditions such as price action or other new developments.

Backtesting: Once the trading strategy was defined, the next step in testing it on historical data from the market is to backtest it to test its performance and to identify any problems. This is an important step because it allows traders see how the strategy performed in the past and then make any changes before it's deployed in live trading.

Coding - After the trading strategy has been backtested and confirmed The next step in the procedure is to program the strategy to create an automatic trading system. This involves writing the guidelines of the strategy using a programming language such as Python (MetaTrader Language) or MQL.

Data input- Automated trading systems require real-time market data to make trading decisions. The data typically comes from a data feed provided by a market data vendor.

Trade execution - After the market data has been processed, and all the conditions required for a trade have met, the automated trade system will perform the trade. This involves sending the instructions for the trade to the brokeragecompany, who will then place the trade in the market.

Monitoring and reporting - Trading platforms that are automated often include monitoring and reporting tools that allow traders track the efficiency of their systems and to identify potential problems. This includes real-time performance as well as alerts for unusual markets activity.

Automated trading is completed in milliseconds. This is much more efficient than human traders can analyze data and then make trades. This speed and precision can lead to more consistent and efficient trading results. To ensure that the system is functioning effectively and is fulfilling your trading objectives It is essential to verify and test the system prior to apply it to live trading. Have a look at the most popular backtesting trading strategies free for more advice including position sizing in trading, best crypto indicators, crypto futures, crypto backtesting platform, crypto backtesting, stop loss order, trading platforms, backtesting platform, best indicator for crypto trading, best free crypto trading bot and more.

What Happened In The Flash Crash 2010

The Flash Crash 2010 was a catastrophic stock market crash that took place on May 6, 2010. The Flash Crash of 2010 was an abrupt, severe stock market crash that took place on May 6, 2010. The causes included:

HFT (High-frequency Trading) HFT (High-frequency Trading) HFT algorithms use complex mathematical models to execute trades based on market data. They comprise the majority of the volume in the stock market. The huge number of transactions executed through these algorithms created volatility in the market and intensified the selling pressure in the flash crash.

Order cancellations- The HFT algorithm was developed to cancel orders when the market is moving in a way that is not favorable. This increased the pressure on sellers during the flash crashes.

Liquidity Flash crash in part caused by a lack in liquidity in the market. A lot of market makers and other participants, temporarily removed their funds from the market in the course of it.

Market structure: With multiple exchanges and dark pool The U.S. Stock market was extremely complex and fragmented. This made it challenging for regulators to to monitor the situation and react to it in real time.

The flash crash had severe effects on the markets for financial instruments. It caused massive losses for individuals as well as participants in the market. There was also an erosion in investor confidence and less stability in the market. Following the flash crash regulators took a variety of measures to improve the stability of stock markets, including circuit breakers which temporarily suspend trading on individual stocks in the event of high fluctuations. They also increased the transparency of markets. Have a look at the top rated forex backtesting software for website tips including position sizing, stop loss meaning, forex tester, forex backtest software, best crypto indicators, algorithmic trade, crypto trading bot, algorithmic trading crypto, automated trading, algorithmic trading bot and more.